Quantitative Finance and Risk Management

Program Goals

The goal of the program is to provide graduates with a strong mathematical background and to develop skills necessary to apply their expertise to the solution of real finance problems.

Students develop modeling skills so that they are able to formulate a well-posed mathematical problem from a description in financial language, carry out relevant mathematical analysis using tools of stochastic analysis and probability theory, implement the results using advanced numerical methods, and interpret and make decisions based on these results.

Coursework

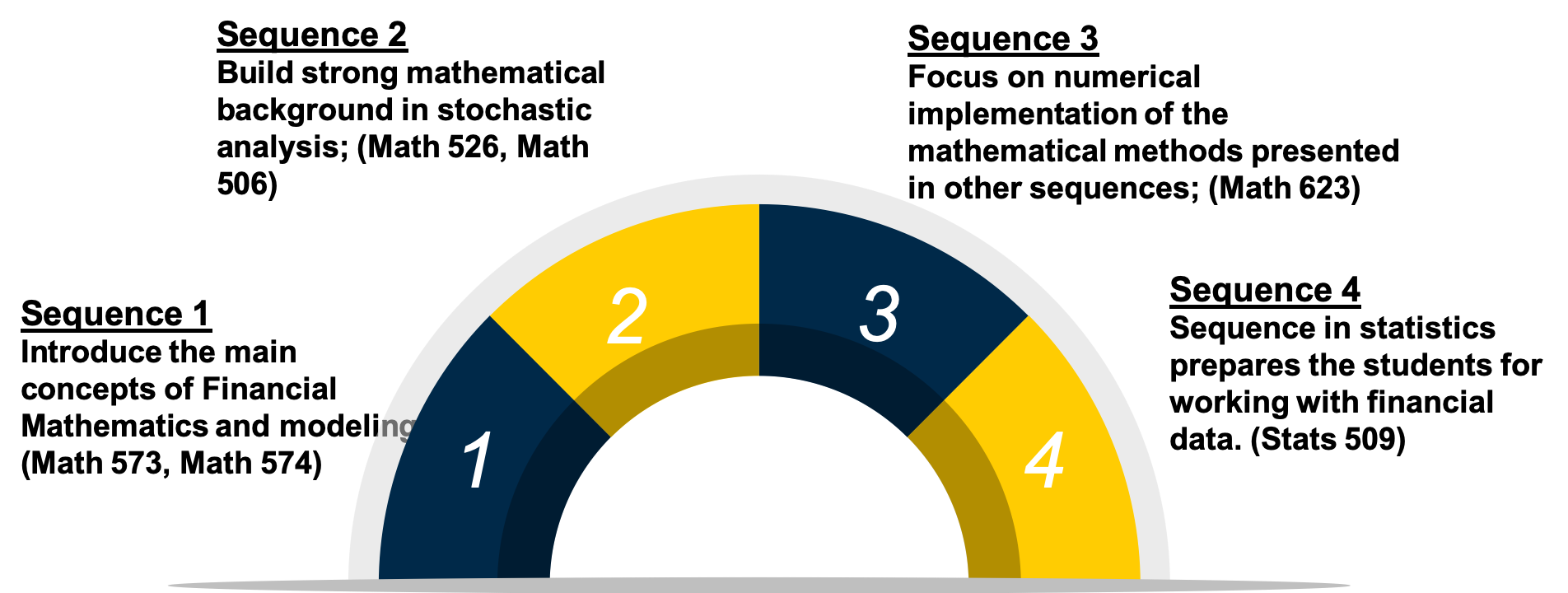

The coursework described below, which includes 24 credits of required courses and 12 credits of electives for a total of 36 credits, lays the foundation for a career as a quantitative analyst in a financial or other institution. These skills will be developed through 4 sequences of required core courses:

Students will also be required to take 12 credits of electives which are offered by:

- Mathematics

- Statistics

- Economics

- the College of Engineering (IOE and Electrical)

- Ross School of Business

These will allow students to develop skills in particular areas (deeper understanding of optimization, economics, statistical methods, data management, special features of financial markets) they are interested in.